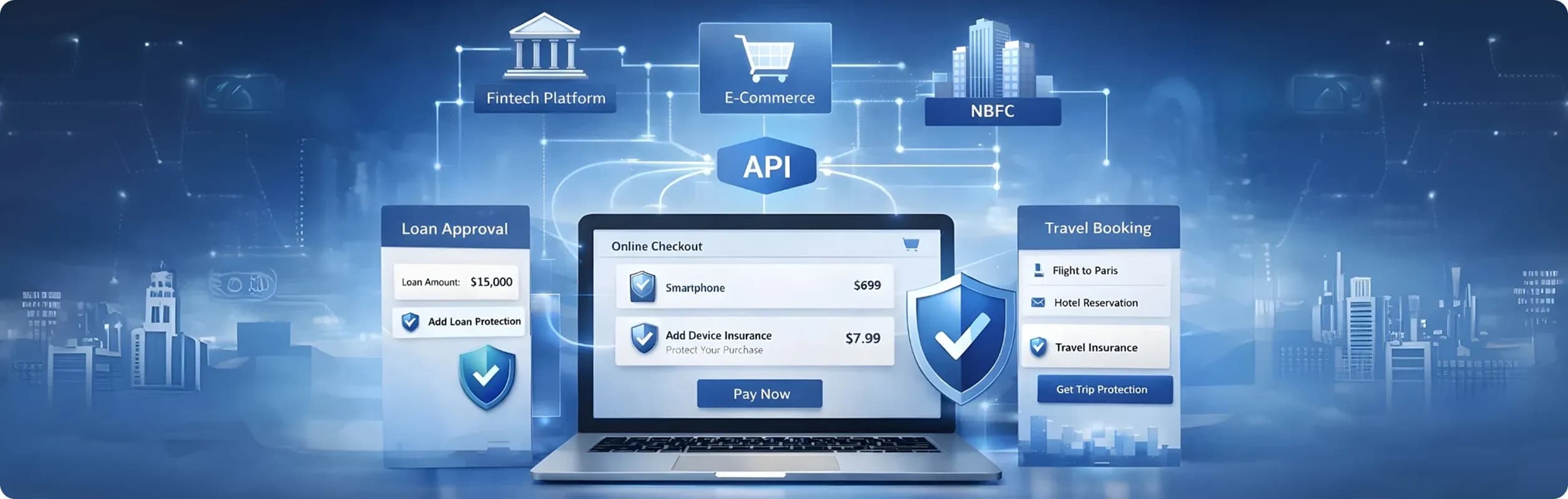

Embedded insurance is rapidly reshaping how protection products are discovered, purchased, and experienced, marking a decisive shift away from traditional, standalone insurance journeys. Instead of asking customers to proactively seek out coverage, embedded insurance integrates relevant protection seamlessly into everyday financial and lifestyle transactions such as taking a loan, booking travel, or purchasing goods on an e-commerce platform. For insurers, fintechs, and NBFCs, this model represents a powerful awareness-stage opportunity to reach customers at the exact moment of need, when context and intent are already established. The appeal lies in simplicity and relevance: insurance is no longer an interruption but a natural extension of the primary product or service. For example, credit protection bundled with loans, device insurance offered at checkout, or travel coverage embedded within booking flows removes friction from the buying process while increasing adoption rates. This shift is driven by changing customer expectations, digital maturity across industries, and the rise of API-driven platforms that make real-time integration possible. As competition intensifies and traditional acquisition channels become more expensive, embedded insurance is emerging as a scalable growth engine that allows insurers to expand reach, diversify distribution models, and build deeper partnerships across ecosystems.

Why Embedded Insurance Is Gaining Momentum Across Ecosystems

Contextual relevance and higher conversion at scale One of the biggest advantages of embedded insurance is its ability to align coverage with a specific customer action. When insurance is offered alongside loans, e-commerce purchases, or travel bookings, customers clearly understand the value of protection in that moment. This contextual relevance significantly improves conversion compared to traditional push-based insurance sales. For insurers, working with fintechs, NBFCs, and digital platforms as distributors enables access to large, digitally engaged customer bases without the overhead of traditional distribution models. The result is lower acquisition costs, higher penetration, and a more predictable flow of business driven by transaction volumes rather than individual sales efforts.

New distribution models beyond traditional channels Embedded insurance fundamentally expands how insurers think about distribution. Instead of relying primarily on agents or direct-to-consumer channels, insurers can integrate their products into third-party platforms that already own the customer relationship. Fintech apps, lending platforms, marketplaces, and travel aggregators become powerful distributors, offering insurance as a value-added service rather than a separate purchase. This model allows insurers to scale rapidly across multiple touchpoints while partners enhance their own offerings through differentiated protection. Importantly, this shift also enables experimentation with new product formats, pricing models, and coverage durations that are better suited to digital consumption.

As embedded insurance continues to evolve, its strategic importance goes beyond incremental revenue. It represents a new way for insurers to stay relevant in a platform-driven economy where customer journeys are increasingly fragmented across services. For insurers, the challenge is not just to participate but to build the capabilities required to support embedded models at scale. This includes designing modular products that can be easily bundled, investing in API-first architectures for seamless integration, and developing flexible underwriting and pricing engines that can respond in real time. Data sharing and analytics also play a critical role, enabling insurers to better assess risk, personalize coverage, and improve loss ratios through insights derived from partner platforms. For fintechs and NBFCs, embedded insurance strengthens customer trust and lifetime value by offering protection that complements core financial products. In the awareness stage of digital innovation, embedded insurance stands out as a compelling narrative: it demonstrates how insurers can move closer to customers, leverage modern distribution ecosystems, and unlock sustainable growth by meeting protection needs exactly where and when they arise without adding friction to the customer experience.