Onboard partners faster through a controlled, compliant platform that preserves governance while scaling distribution operations.

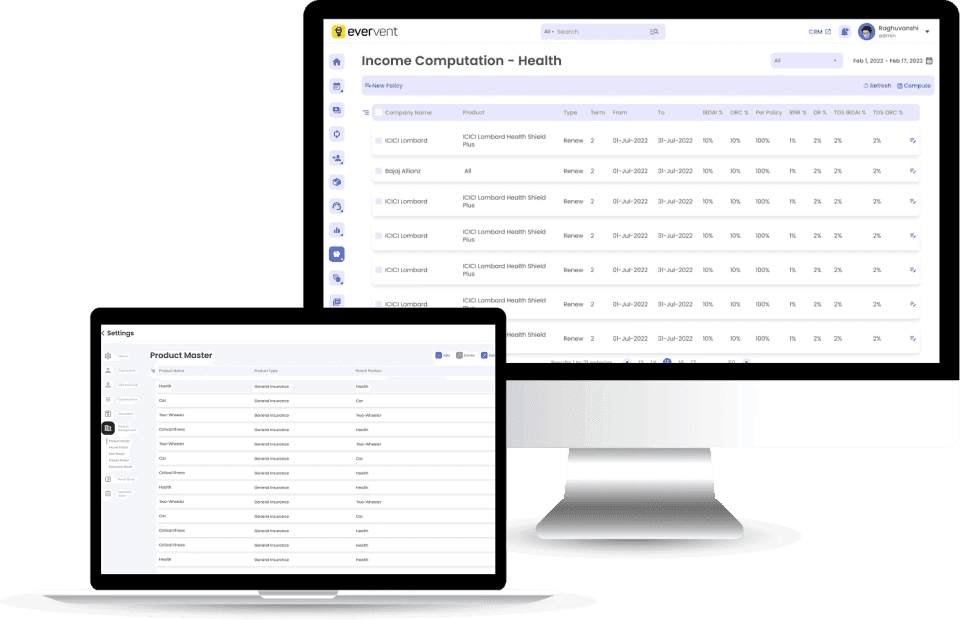

For insurers, onboarding is a strategic control point that directly impacts compliance, underwriting discipline, operational efficiency, and brand trust. As distribution networks expand across regions, products, and partner types, traditional onboarding methods such as manual checks, fragmented systems, and ad hoc approvals create delays and regulatory risk. Evervent’s Onboarding Management System enables insurers to onboard, govern, and activate partners through a structured, compliant, and fully auditable framework. It standardises processes across channels while maintaining full control, allowing faster distribution expansion without compromising governance or operational integrity.

Every onboarding rule, workflow, and approval hierarchy is defined by the insurer, ensuring governance remains centralized even as distribution scales.

Regulatory and internal compliance checks are built directly into onboarding flows, reducing downstream risk and corrective actions.

New partner types, products, or regions can be onboarded using the same framework, without redesigning workflows or systems.

Automation reduces manual effort while maintaining full audit trails, ownership, and traceability at every step.

Evervent ensures that growth in distribution does not dilute control, data integrity, or regulatory discipline.

Evervent enables insurers to define uniform onboarding journeys for distributors, POS agents, and corporate channels, ensuring consistency across regions and partner types while removing execution ambiguity.

Insurers can configure mandatory onboarding criteria including licensing validations, regulatory checks, internal risk parameters, and eligibility rules that are enforced systematically to reduce manual effort and compliance gaps.

The platform supports onboarding across diverse distribution models and geographies from a single control layer, allowing insurers to scale nationally or regionally without parallel processes.

All onboarding documents such as KYC, licences, agreements, and compliance declarations are captured, validated, versioned, and stored centrally to ensure audit readiness and document traceability.

Evervent allows insurers to define granular roles, permissions, and multi-level approval workflows, enabling efficient execution while maintaining risk and compliance oversight.

Explore our FAQ section for immediate answers to common queries. Discover solutions to your challenges and gain insights into our offerings.

What is Evervent's Onboarding Management System for insurers?

Evervent's Onboarding Management System is a centralized platform that enables insurers to onboard, validate, approve, and govern distributors, POS agents, and corporate channels through a structured, compliant, and auditable framework.

Who within the insurer organization typically uses this system?

The system is designed for distribution, operations, compliance, and risk teams. Role-based access ensures each function operates within defined permissions while maintaining central governance.

How does the platform ensure regulatory and internal compliance?

Compliance is embedded into the onboarding workflow through configurable eligibility rules, mandatory validations, document checks, and approval hierarchies defined by the insurer—ensuring adherence to regulatory and internal policies.

Does the platform support onboarding across multiple regions or geographies?

Yes. The system supports multi-region and multi-channel onboarding from a single control layer, enabling insurers to scale distribution without creating parallel or fragmented processes.

How are onboarding documents managed within the platform?

All documents such as KYC, licenses, agreements, and compliance declarations are centrally captured, validated, versioned, and stored—ensuring traceability, audit readiness, and easy renewals or re-validation.